Problem statement – Current Telecom landscape

Due to today’s telecom climate, landline service providers are experiencing significant subscriber loss due to wireless and other cable TV service providers. This has resulted in significant pressure to reduce costs in order to stabilize their financial position. Current telecom investments are focused predominately on wireless and FIOS/U-verse/LTE opportunities.

The era of universal service and five 9’s reliability being the hallmark of the telecom industry has been replaced by “cellular like” grade of service and access. Subscribers are only focused on the lowest cost and must therefore be persuaded by bundled offerings to switch carriers. The era of innovation in the traditional land line business is over.

Today’s telecom infrastructure was built during the days of the Bell System monopoly which guaranteed universal service, five 9’s reliability, and 40 year depreciation cycles. Today’s telecom equipment vendors are experiencing downstream pressures as a result of the fundamental shift in technology and customer expectations. Today’s product life cycles are short lived; 18 months to a maximum of 3 years as technology shifts force vendors to create new products or die in today’s marketplace. Vendors can no longer afford to support legacy equipment that was designed and built 10 to 20 years ago while service providers are looking to cut maintenance costs to stay competitive.

This dichotomy is causing a fundamental shift in the maintenance support of legacy systems. Smaller telecom vendors have resorted to “Maintenance Extortion” to keep service providers on the hook to keep paying extravagant maintenance contract fees for a legacy product. Due to the proprietary nature of many of these legacy products, service providers are in a financial quandary. On the one hand they can no longer afford to pay the “maintenance ransom”, and on the other hand, they cannot afford to migrate the legacy systems to newer technologies due to the cap on investment on the legacy landline network.

The ability to support the embedded base of equipment is also at a crossroads due to the inability of existing equipment vendors to build or locate spares, and the inability to support code revisions or solve hardware obsolescence issues due to lack of experienced engineers. These vendors are primarily focused on sales of newer products and not legacy equipment. This has resulted in a crippling effect on the traditional landline industry and its ability to support the current and declining subscriber base based on earlier expectations for service and reliability. The Achilles Heel to the entire network has become the on-going support of small companies and their niche products.

Proposed solution – Future Telecom landscape

In order to support the aging telecom infrastructure, it is apparent that a renewed and invigorated business model be created between service provider and equipment vendors to support legacy equipment. ZT has created the support infrastructure to support this multi-vendor legacy equipment environment. ZT has developed a strategic partnership between the service providers and large scale Multi-Vendor Networking (MVN) providers to identify critical products/technologies and vendors that are critical to today’s telecom infrastructure. ZT is a key enabler to continue to maintain a service provider’s Network by extending the life of the legacy equipment.

In partnership with MVN providers, we have sufficient depth in customer support engineers and infrastructure to support service providers’ current embedded base of legacy telecom network equipment. Typically the MVN has been able to satisfy the maintenance support needs of many legacy products due to the large embedded base of existing equipment and access to spares and technical resources. The key problem for the MVN program is to determine how best to support niche or small call volume legacy products (typically about 300 calls per year or less). Many of these products are small in embedded base (less than $100M in total revenue) and are dominated by small, weak, and financially unstable companies or are currently owned by a larger company through an earlier acquisition. Often, the primary driver for the acquisition was to gain new customers and markets in the telecom service provider space and to provide a ready customer for their new “migration” product. Consequently, as product sales evaporated and maintenance revenue remained, these companies resorted to “Maintenance Extortions” to fund the development of new products, realizing that they had a captive customer. ZT was created to solved this problem.

As part of the MVN program, MVN providers are forced to accept the onerous Back-to-Back agreement to maintain the existing niche products in support of the Service Provider network. ZT has proven repeatedly, that we have the expertise and knowledge to “in-source” this support expertise and thereby eliminate these onerous Back to Back expenses, by providing a low-cost alternative to the OEM for legacy support. We have developed case studies that shows the economic savings by deploying our model and have experienced between a 3:1 and 4:1 savings over existing maintenance costs.

Case Study

Company A had purchased a small company, company B, for its carrier-grade products which had a $100M embedded base in a service provider’s network. Company A was developing its next generation product, XYZ, to replace the existing company B product and to sell to new markets in the service provider’s wireline and wireless network space. The Service provider had a maintenance contract in place with Company A for $2.1M/year for an estimated calling volume of 22 calls per year. In order to provide continued support for this legacy product ZT entered into a Back-to-Back (B2B) agreement for approximately $2.1M/year. In order to reduce these maintenance expenses, ZT began to a) re-negotiate with Company A for a lower B2B fee, and b) attempt to create an equivalent support structure.

ZT Flexible Support Model

Company A began the process of downsizing its support structure for this legacy product. ZT developed a flexible support model utilizing a team of full-time SME personnel and part-time personnel ( previously employed by Company A) and supplemented with individuals from our existing infrastructure support team. With this team in place, ZT terminated the B2B agreement and began discussions to purchase all available spares and necessary documentation, tools, and intellectual property necessary to support the product.

ZT Business Case Highlights

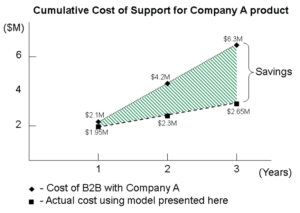

♦ ZT B2B expenses: $2.1m/year or $6.3M over 3 years

♦ ZT hiring of contractors: $0.35M/year or $1.05M over 3 years

♦ ZT purchase of all available spares, documentation, tools, IP: $1.6M

♦ Total cost for ZT Flexible Support Model: $2.65M over 3 years

♦ Net Savings over B2B: $6.3M-$2.65M => $3.65M or 58% savings over initial B2B costs

Payback Period: Less than 1 year

© Copyright 2018. All Rights Reserved ZT Technology Solutions